Year Kronor Year

1900 . . . 10 904 708*77 1905 . .

1901 . . 8589 070*02 1906 . .

1902 . . 13 678 806*18 1907 . .

1903 . . . 15 968 497*33 1908

1904 . . . 21 272 817*09 1909 . .

Kronor Year Kronor

19 403 430*11. 1910 , . . . 19 474050*70

17 611155*54 1911 . . . . 14128 444*62

11 752 405*51 1912 . . . . 19 032110*32

26 611278*78 1913 . . . . 14 499 534*90

18 181 039*47

Total 683 563 594*55

Deduct: loans r e p a id ................................................................................... . 309 959 684*35

Original loan-total on the 31 December, 1913 amounted to . . . . . . . . 373303910*20

Amount amortized:

On the 31 December, 1913 76 127 072*97

*The net amount of the loan on the 31 December, 1913 297 47(5837*23

A comparison between the value of the estates securing admission to the

Mortgage Bank, the amount to which the land-owners had the right to borrow,

the original loan-capital, and the value and number of the outstanding loans on

the 31 December, 1913, is shown by the auditors’ report, as given in Table 30.

The amount of the existing loans, therefore, amounts to not quite 34 % of

the estimated value of the estates.-

Superintended and supported by the State, the Swedish General Mortgage

Bank has won great public confidence, and its credit is exceedingly

good. Its bonds, too, have long teen quoted at prices which are approximately

the same as those of the Swedish Government Stock. From Table

29 it is seen that the Mortgage Bank reserves the right, from the year

1889, to give notice of redemption of its bond loans 10 years after the

loan has been granted, while earlier loans were locked up for from 24 to

81 years, and one loan, indeed, cannot be called in at all.

This change in the loan-policy has been made in order to confer on

the participating Societies the same right in this matter as that possessed

by the Bank, whereby, again, the Societies would be enabled to give

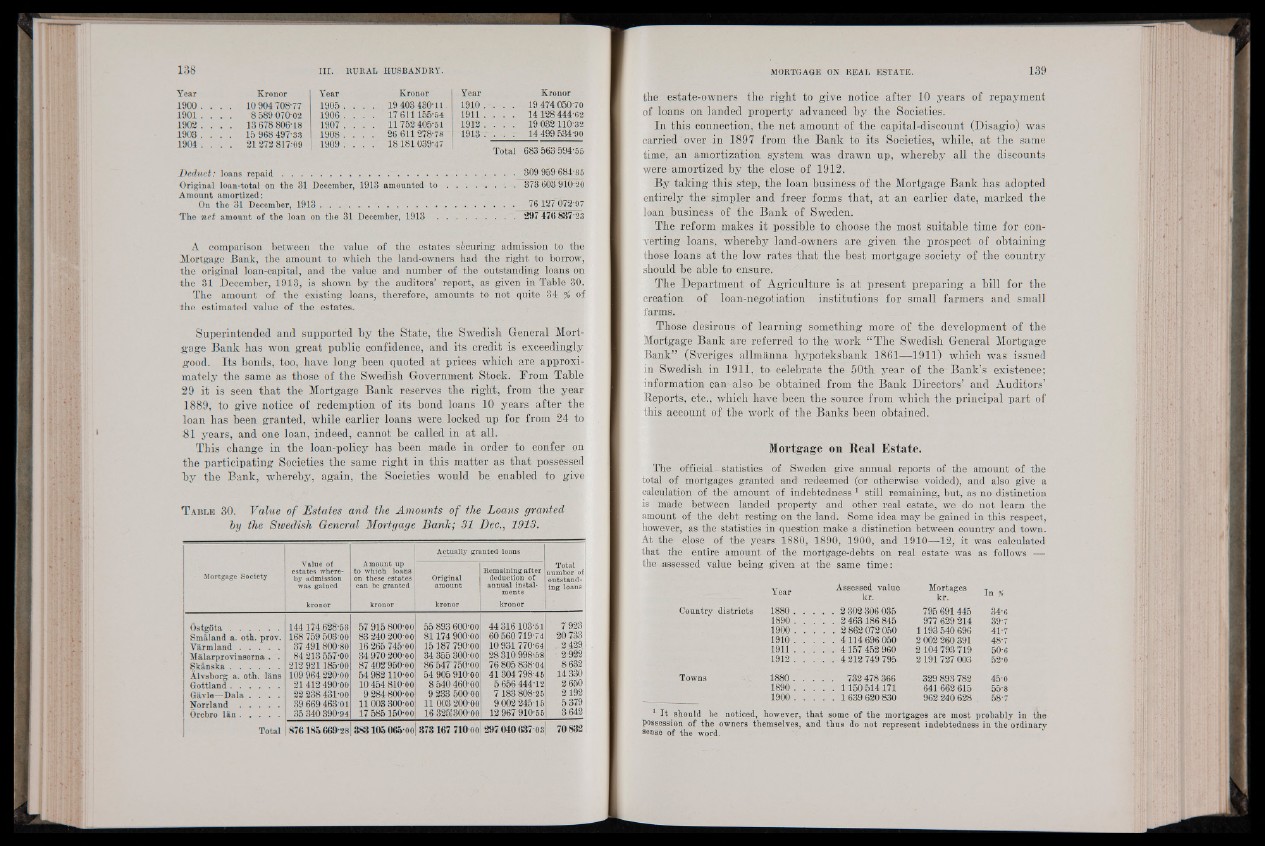

T a b l e 30. Value of Estates and the Amounts of the Loans granted

by the Swedish General Mortgage Banlc; 31 Dec., 1913.

Value of

estates whereby

admission

was gained

kronor

Amount up

to which loans

on these estates

can be granted

kronor

Actually granted loans

Mortgage Society Original

amount

kronor

Remaining after

deduction of

annual instalments

kronor

Total

number of

outstanding

loans

Ôstgota ....................

Smâland a. oth. prov.

Y a rm lan d ................

Malarprovinserna . .

Skânska ....................

Àlvsborg a. oth. Ians

Gottland....................

Gavie—Dala . . . .

N o r r la n d ................

Örebro la n ................

144174 628*53

168 759 503*00

37 491800*80

84 213 557*00

212 921185*00

109 964 220*00

21412 490*00

22 238 431*00

39 669 463 01

35 340 390*94

57 915 8OO-00

83 240 200*00

16 265 745*00

34 970 200*00

87 402*950*00

54 982 110*00

10 454 810*00

9 284 800*00

11 003 300*00

17 585 150*00

55 893 600*oo

81174 900*00

15187 790*00

34 355 300*00

86*547*750*00

54 905 910*00

8 540 460*00

9 233 500 oo

11 003 200*00

16 3251300*00

44 316103*51

60 560 719*74

10 931 770*64

28 310998:68

76 805 838*04

41 304 798*46

5 656 444*12

7 183 808*25

9 002 245*15

12 967 910*55

7923

20733

.2 42.9

2*922

8 632

14 330

2 650

2192

5 379

3 642

Total 876185 669*28 383 105 065*Oo| 373167 710*oo 297 040 637 03 70 832

the estate-owners the right to give notice after 10 years of repayment

of loans on landed property advanced by the Societies.

In this connection, the net amount of the capital-discount (Disagio) was

carried over in 1897 from the Bank to its Societies, while, at the same

time, an amortization system was drawn up, whereby all the discounts

were amortized by the close of 1912.

By taking this step, the loan business of the Mortgage Bank has adopted

entirely the* simpler and freer forms that, at an earlier date, marked the

loan business of the Bank of Sweden.

The reform makes it possible to choose the most suitable time for converting

loans, whereby land-owners are given the prospect of obtaining

those loans at the low rates that the best mortgage society of the country

should be able to ensure.

The Department of Agriculture is at present preparing a bill for the

creation of loan-negotiation institutions for small farmers and small

farms.

Those desirous of learning something more of the development of the

Mortgage Bank are referred to the work “The Swedish General Mortgage

Bank” (Sveriges a-llmanna hypoteksbank 1861 1911) which was issued

in -Swedish in 1911, to celebrate the 50th year of the Bank’s existence;

information can-also be obtained from the Bank Directors’ and Auditors’

Reports, etc., which have been the source from which the principal part of

this account of the work of the Banks been obtained.

Mortgage on Real Estate.

The official- statistics *. of Sweden give annual reports of the amount of the

total of mortgages granted and redeemed (or otherwise voided), and also give a

calculation of the amount of indebtedness 1 still remaining, but, as no distinction

is mad® «between landed property and other real estate, we do not learn the

amount of the debt resting on the land. Some idea may be gained in this respect,

however, as the statistics in question make a distinction between country and town.

At the close of the years 1880, 1890, 1900, and 1910—12, it was calculated

that the entire amount of the mortgage-debts on real estate was as follows —

the assessed value being given at the same time:

-Yit ear As—se ss,ed value kr.

Country districts 1880 ................ 2 302 306 035

§¿1890 . . . . . 2463186845

1900 ................ 2 862 072 050

1910 ................ 4114 696 050

1911 ................ 4157452 960

1912 . . . . . 4 212 749 795.

Towns 1880 ................ 732 478 366

1890 ................ 1150 514171

1900 ................ 1639 620830

Mortages T

kr. In *

795 691445 34*6

977 629 214 39*7

1193 540 696 41*7

2 002 260 391 48*7

2 104 793 719 50*6

2 191 727 003 52*0

329 893 782 45*0

641 662 615 55*8

962 240 628 58*7

It should be noticed, however, that some of the mortgages are most probably in the

possession of the owners themselves, and thus do not represent indebtedness in the ordinary

senso of the word.