before the introduction of the malt-tax, the number of small-beer breweries

was estimated to be about 400, instead of the more than 900 that they afterwards

proved to be.

The report for the taxation-year 1912/13 shows that lager-beer forms the

greater part of the liquor manufactured in the breweries paying excise, or 40 '2 %

of the whole, while pilsener-beer comes next, with 23'6 %. It is also seen that

porter is manufactured chiefly in Gothenburg; lage>beer mostly in Southern and

Western Sweden; pilsener-beer mostly in Stockholm and Norrland, lager- and

pilsener-small-beer mostly in Stockholm and Gothenburg. Of the largest breweries

subject to the payment of excise, 4 are situated in Stockholm and 2 in Gothenburg;

altogether these used a total of 10 591 820 kg of Inalt, or 39'3 % of all the

malt used in the country, and paid in excise 2 382 118'60 kronor, or 43 ‘9 % of

the entire excise paid in the country. Of the breweries subject to excise, the

greater number (119) are situated in the towns, while 71 are situated in country

districts. The strength of the wort amounted on an average to the following fi-

gures for:

Porter ....................................................... 17‘5—19 0 % Balling

Lager-beer. ............................................110—12’5 > >

Pilsener-beer ........................................10*5—1 15 , _ >

Lager- and pilsener-small-beer........................ 8 o-ffl9'0 » »

Small-beer........................................................... 4'0— 5'5 » >

The average price of barley amounted to about 16 kronor, and of hops to

about 350 kronor per 100 kg. With these prices of barley and hops, it is

estimated that the cost of ingredients for:

1 liter lager-beer amounts t o 7-0 6re

1 > pilsener-beer amounts t o J ij >

1 > lager- and pilsener small beer amounts to . . . . 5 o »

Of the excise-free breweries, 534 used malt to a weight of not more than

20 000 kg, from which it may be seen that, on the whole, the small-beer industry

is carried on as an inconsiderable handicraft.

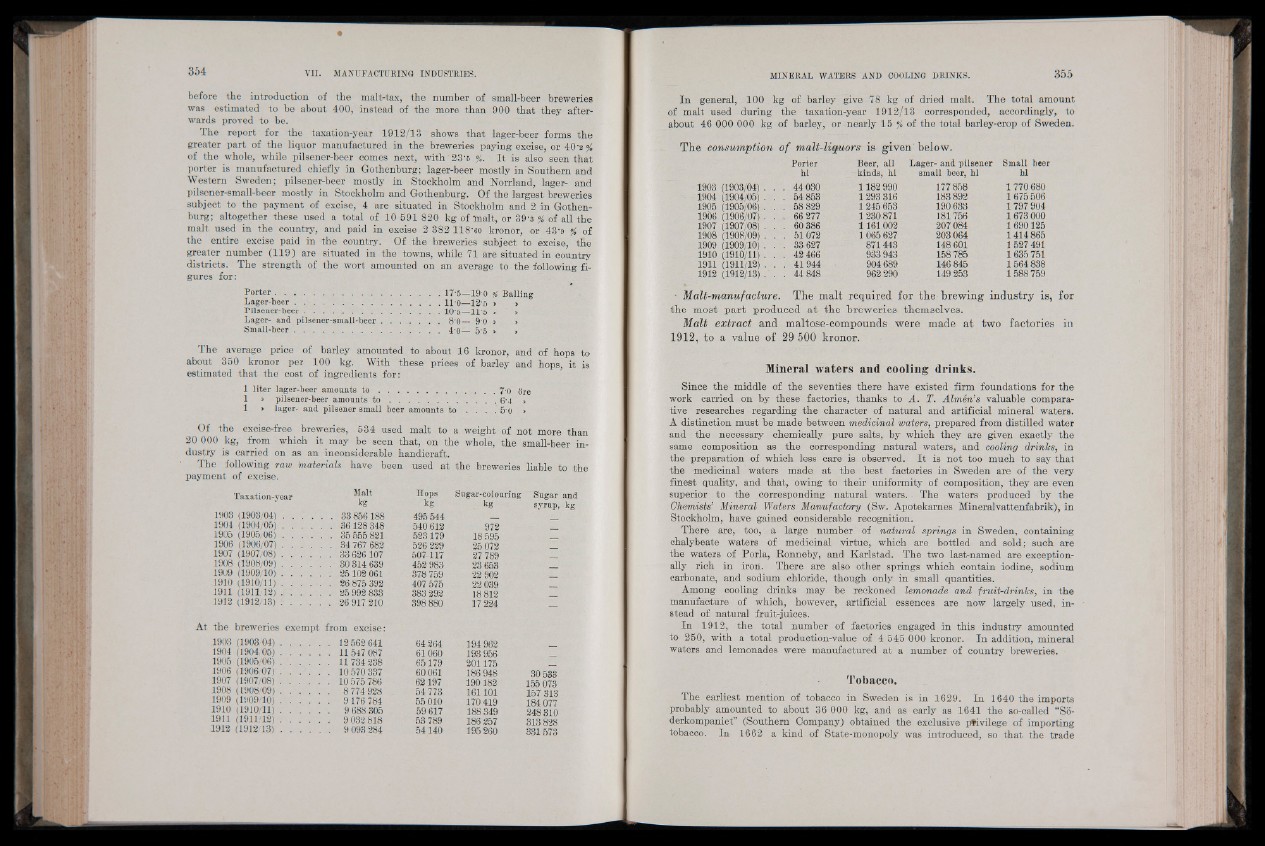

The following raw materials have been used at the breweries liable to the

payment of excise.

Taxation-year Malt Hops Sngar-colonring Sugar and

kg kg . kg syrup, kg

1903 (1903/04) . . . . 33 856 188 495 544

1904 (1904/05) . . . . 540 612 972

1905 (1905/06) . . . . 35 555 821 523 179 18 595

1906 (1906/07) . . . . 34 767 682 526 229 25 072

1907 (1907/08) . . . . . . 33 626 107 507-117 27 789

1908 (1908/09) . . . . 30 314 639 452 983 23 653

1909 (1909/10) . . . . 25 102 061 378 759 22 902

1910 (1910/11) . . . . . I 26875 392 407 575 22 039

1911 (1911/12) , . . . . . 25 992 833 383 292 18 812

1912 (1912/13) ? . . . 398 880 17 224 _

At the breweries exempt from excise:

1903 (1903, 0 4 ) .................... 12 562 641

1904 (1904/05).................... 11547 087

1905 (1905/06).................... 11734 238

1906 (1906/07) . . . . . 10 570 337

1907 (1907/08).................... 10575786

1908 (1908/09).................... 8774 928

1909 (1 9 0 9 /1 0 )................. 9176 784

1910 (1910/11).................... 9 688 305

1911 (1911/12).................... 9 032 818

1912 (1912/13).................... 9 093 284

64 264 194 962

61060 193 956 _

65179 201175

60 061 186 948 30533

62197 190182 155 073

54 773 161101 157 313

55 010 170 419 184 077

59 617 188 349 248 310

53 789 186 257 313 828

54140 195 260 331 573

In general, 100 kg of barley give 78 kg of dried malt. The total amount

of malt used during the taxation-year 1912/13 corresponded, accordingly, to

about 46 000 000 kg of barley, or nearly 15 / of the total barley-crop of Sweden.

The consumption o f malt-liquors is given below.

1903 (1903/04).

1904 (1904/05) .

1905 (1905/06).

1906 (1906/07).

1907 (1907/08) .

1908 (1908/09) ,

1909 (1909/10) :.

1910 (1910/11) .

1911 (1911/12) ,

1912 (191-2/13) .

Porter Beer, all Lager- and pilsener Small beer

hi kinds, hi small beer, hi hi

44 030 1182 990 177 858 1 770 680

54 853 1293 316 183 892 1675 506

58 829 : 1245 653 190 633 1797 904

66 277 1 230 871 181756 1673 000

60 386 1161002 207 084 1 690125

51072 1 065 627 203 064 1414 865

33 627 871443 148 601 1527 491

42 466 933 943 158 785 1 635 751

41 944 904 689 146 845 1564 838

44 848 962 290 149 253 1588 759

• Malt-manufacture. The malt required for the brewing industry is, for

the most part produced at the breweries themselves.

Malt extract and maltose-compounds were made at two factories in

1912, to a value of 29 500 kronor.

Mineral waters and cooling drinks.

Since the middle of the seventies there have existed firm foundations for the

work carried on by these factories, thanks to A. T. Almen’s valuable comparative

researches regarding the character of natural and artificial mineral waters.

A distinction must be made between medicinal waters, prepared from distilled water

and the necessary chemically pure salts, by which they are given exactly the

same composition as the corresponding natural waters, and cooling drinks, in

the preparation of which less care is observed. It is not too much to say that

the medicinal waters made at the best-/ factories in Sweden are of the very

finest quality, and that, owing to their uniformity of composition, they are even

superior to the corresponding natural waters. The waters produced by the

Chemists’ Mineral Waters Manufactory (Sw. Apotekames Mineralvattenfabrik), in

Stockholm, have gained considerable recognition.

There are, too, a large number of natural springs in Sweden, containing

chalybeate waters of medicinal virtue, which are bottled and sold; such are

the waters of Porla, Eonneby, and Karlstad. The two last-named are exceptionally

rich in iron. There are also other springs which contain iodine, sodium

carbonate, and sodium chloride, though only in small quantities.

Among cooling drinks may be reckoned lemonade and fruit-drinks, in the

manufacture of which, however, artificial essences are now largely used, instead

of natural fruit-juices.

In 1912, the total number of factories engaged in this industry amounted

to 250, with a total production-value of 4 545 000 kronor. In addition, mineral

waters and lemonades were manufactured at a number of country breweries.

Tobacco.

The earliest mention of tobacco in Sweden is in 1629. In 1640 the imports

probably amounted to about 36 000 kg, and as early as 1641 the so-called “So-

derkompaniet” (Southern Company) obtained the exclusive privilege of importing

tobacco. In 1662 a kind of State-monopoly was introduced, so that the trade