were reinsured; the takings in the form of premiums for these insurances

were 15-8 million kronor, and the compensations paid out totalled 10-6

million kronor. The gross value of the Swedish insurances should thus

aggregate over 12-9 milliards of kronor; in order then to find the net

amount of fire insurance for Sweden, one must, of course, deduct from

the grass total the amounts reinsured in Swedish companies or in the

Swedish general agencies of foreign companies, and add to it any insurances

taken direct from the Company abroad and not reinsured in Sweden.

How the gross insurance sum is distributed between real and movable

property is not clearly shown by the figures.

Life insurance — at any rate in the form of funeral benefits — as well

as several other kinds of personal insurance, was practised by the ancient

guilds, though in more or less rudimentary forms. But modern life insurance

based on scientific principles was first introduced into Sweden

by the Skandia Fire and Life Insurance Company (1855), which

was next succeeded by Svea (1867). The first Swedish joint-stock-

company with solely life insurance (in a wide sense: life, life annuity, and

capital insurance) was Nordstjernan (1872). Next came Thule (1873),

which by the principles on which it was constituted afforded a transition

to the mutual companies, Victoria (1883) and Norrland (1890); Skane

(1884) also transacts fire insurance business, while, on the other hand,

Nordpolen (1897) is only a life insurance company.

Besides this, there were 14 mutual companies (most of them with gua-

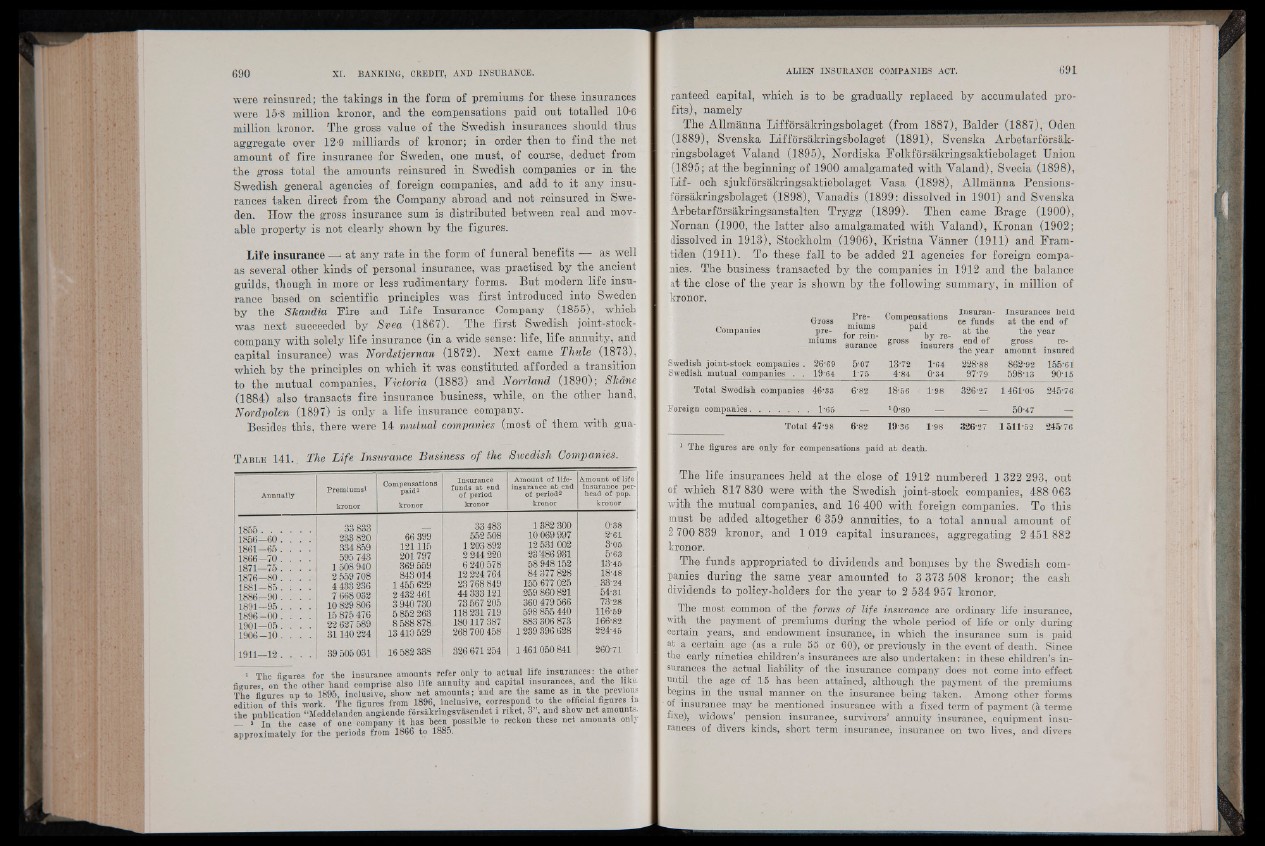

T a b l e 141. The Life Insurance Business of the Swedish Companies.

A n n u a lly

P r em iu m s1

k ro n o r

C om p e n s a tio n s

p a id1

k r o n o r

I n s u r a n c e

f u n d s a t e n d

o f p e r io d

k ro n o r

A m o u n t o f lif e -

in s u r a n c e a t e n d

o f p e rio d ^

k ro n o r

A m o u n t o f life

in s u r a n c e p e r-

h e a d o f p o p .

k r o n o r

1855 33833 33 483 1382 300 0-38

1856—60 • 233 820 66 399 552 508 10 069 997 2-61

1861—65 334 859 121115 1 203 892 12 531 002 305

1866—70 . . . . 595 743 201797 2 244 220 23’486 931 5-63 '

1871_75 . . . . 1 508 940 369 559 6 240 578 58 948 152 13-45

1876—80 . . . . 2 559 708 843 014 12 224 764 84 377828 18-48

1881—85 4 433 236 ' 1455 629 23 768 849 155 677 025 _ 33-24

1886—90 . . . . 7 668 032 2 432 461 44 333121 259 860 821 54-31

1891—95 . . . . 10 829 806 3 940 730 73 567 205 360 479 566 73-28

1896—00. . . . 15 875 476 5 852 263 118 231 719 598 855 440 116-59

1901_05 22 627 589 8 588 878 180117387 883 306 873 166-82

1906-10. . . . 31140 224 13 410 529 268700 458 1 239 396 628 224-45

1911—12 . . . . 39 505 031 16 582 338 326 671254 1461050 841 260-71

1 The figures for the insurance amonnts refer only to actual life insurances; the other

°-nre» on the other hand comprise also life annuity and capital insurances, and the like,

’he figures up to 1895, inclusive, show net amounts; H are the same as in the previous

dition of this work'. The figures from 1896, inclusive, correspond to the official figures in

he publication “Meddelanden angdende fdrs&kringsv&sendet l nket, 3 , and show net amounts.

- a In the case of one company it has been possible to reckon these net amounts only

pproximately for the periods from 1866 to 1885.

ranteed capital, which is to be gradually replaced by accumulated profits),

namely

The Allmanna Lifforsakringsbolaget (from 1887), Balder (1887), Oden

(1889), Svenska Lifforsakringsbolaget (1891), Svenska Arbetarforsak-

ringsbolaget Valand (1895), Nordiska Folkfdrsakringsaktiebolaget Union

(1895; at the beginning of 1900 amalgamated with Yaland), Svecia (1898),

Lif- och sjukforsakringsaktiebolaget Yasa (1898), Allmanna Pensions-

forsakringsbolaget (1898), Vanadis (1899: dissolved in 1901) and Svenska

Arbetarforsakringsanstalten Trygg (1899). Then came Brage (1900),

Nornan (1900, the latter also amalgamated with Yaland), Kronan (1902;

dissolved in 19.13), Stockholm (1906), Kristna Yanner (1911) and Fram-

tiden (1911). To these fall to be added 21 agencies for foreign companies.

The business transacted by the companies in 1912 and the balance

at the close of the year is shown by the following summary, in million of

kronor.

Companies

Swedish joint-stock companies .

Swedish mutual companies . .

Gross

pre-

26-69

19-64

Premiums

for reinsurance

5-07

1-75

n 1 „ __ Insuran-Compensations „ . InsurancesA hecld r ■ 3 ce funds at the end of

PaI* at the

i>nsurreer-s en■d of the year

gross

13-72

4-84

1-64

0-34

228-88

97-79

the year

gross reamount

insured

862-92 155-61

598-13 90-15

Total Swedish companies 46-33 6 82 18-56 198 326'27 1461-05 245'76

Foreign companies. . 1-65 'O-so — 50-47

Total 47-98 6-82 1936 198 326'27 1511-52 245 76

1 The figures are only for compensations paid at death.

The life insurances held at the close of 1912 numbered 1 322 293, out

of which 817 830 were with the Swedish joint-stock companies, 488 063

with the mutual companies, and 16 400 with foreign companies. To this

must be added altogether 6 359 annuities, to a total annual amount of

2 700 839 kronor, and 1019 capital insurances, aggregating 2 451 882

kronor.

The funds appropriated to dividends and bonjises by the Swedish companies

during the same year amounted to 3 373 508 kronor;, the cash

dividends to policy-holders for the year to 2 534 957 kronor.

The moat common of the forms of life insurance are ordinary life insurance,

with the payment of premiums during the whole period of life or only during

certain years, and endowment insurance, in which the insurance sum is paid

at a certain age (as a rule 55 or 60), or previously in the event of death. Since

the early nineties children’s insurances are also undertaken: in these children’s insurances

the actual liability of the insurance company does not come into effect

until the age of 15 has been attained, although the payment of the premiums

begins in the usual manner, on the insurance being taken.. Among other forms

' of insurance may be mentioned insurance with a fixed term of payment (a terme

fixe), widows’ pension insurance, survivors’ annuity insurance, equipment insurances

of divers kinds, short term insurance, insurance on two lives, and divers