other combinations. Insurances of these kinds can as a rule be obtained with

or without medical examination. In the latter case the companies safeguard

themselves against the risks of bad selection by a restriction of the company’s

liability during a certain term (“harens”). The Swedish term for insurance of

this latter kind is “harensforsakring".

Vigorous efforts have been made during recent years to extend the benefits

of insurance to the lower classes, both by the older companies in which the

average insurance sum per policy-holder has in consequence shown a certain

tendency to diminish, and also by certain institutions that have made it their

special business to grant what is termed “folkfôrsàkring” (industrial insurance),

modelled on similar institutions abroad.

In 1906 was formed the Svenslca liffôrsàlcringsbolagens direMorsforening (the

Swedish Life Insurance Companies Directors’ Association), which, embracing

as it now does practically all the Swedish life insurance companies, forms a

rallying-point for deliberations on the common interests of the companies.

As regards the extent to which life insurance occurs, whether alone or

along with other forms of personal insurance, in numerous funds and societies

of divers kinds, large and small, the reader is referred to the'section

Social Movements (p. I. 631).

The 14 public interest and capital insurance institutions (rante- och hapi-

talforsakringsanstalter) and that belonging to the “Civil Service” (Civil-

staten) paid out in 1912 in annuities a total of 892 135 kronor, in accumulated

capital 558 770 kronor, and in inheritance and annuity benefits

669 627 kronor; the funds administered in these institutions amounted ¡fin

the same year to 64 362 727 kronor.

Accident Insurance was carried on in Sweden, as in other Scandinavian

countries, prior to 1881 only by foreign companies, and on quite a minor

scale. In 1881, however, the Fylgia Company was formed, and several

other accident insurance companies were successively founded. Besides

Fylgia, the following joint-stock companies carried on accident insurance

in Sweden in 1911: Skandinavien (since 1886), Norden (1888), Heimddll

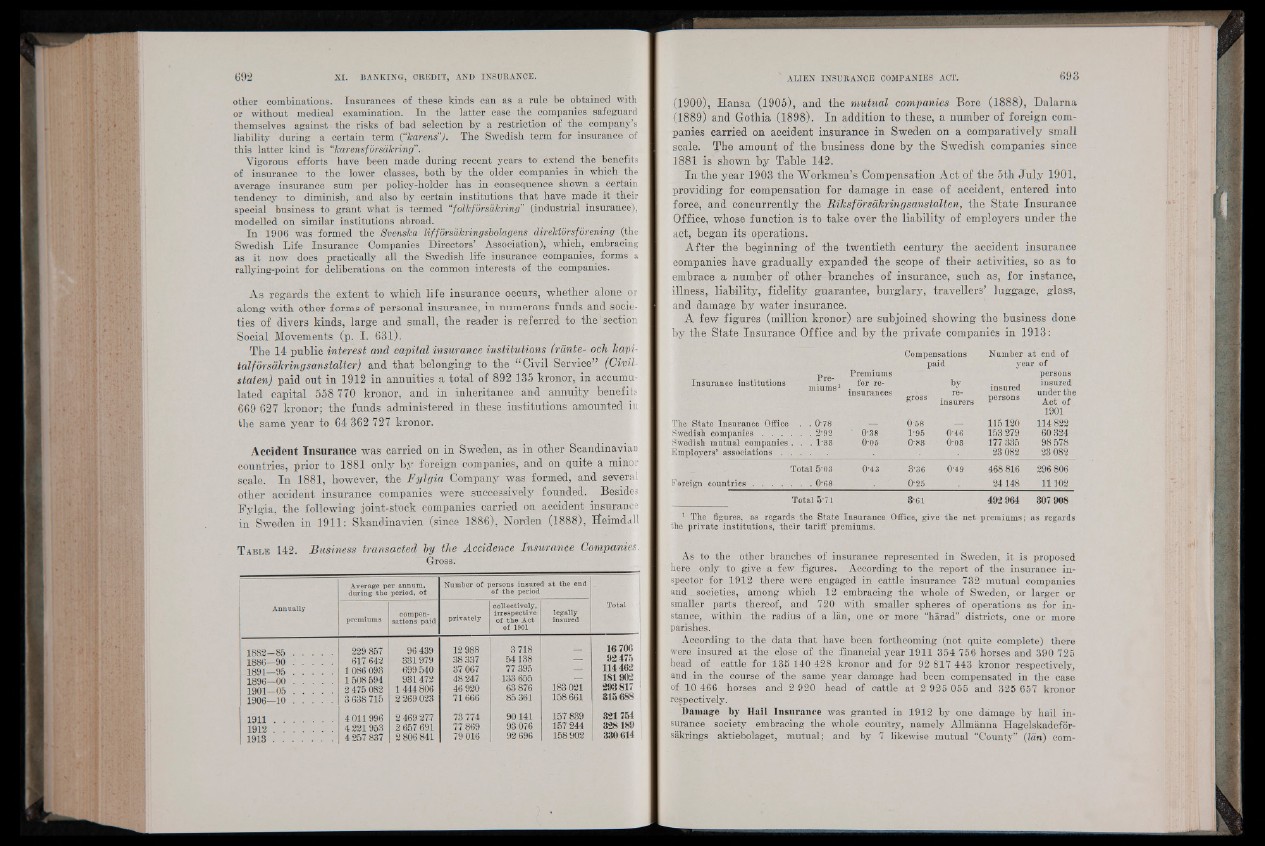

T able 142. Business transacted by the Accidence Insurance Companies.

Gross.

Average per annum,

during the period, of

Number of persons insured a t tbe end

of tb e period

Annually Total

premiums

compensations

paid privately

collectively,

irrespective

of the Act

of 1901

legally

insured

1882—85 ................ 229 857 96 439 12 988 3718 16706

1886—90 ................ 617 642 331979 38 337 54138 92 475

1891—95 ................ 1 086 093 699 540 37 067 77 395 - , £ 1 E 114462

1896—00 ................ 1508594 931472 48 247 133 655 — 181902

1901—05 ................ 2475 082 1 444 806 46 920 63876 183 021 293817

1906—10 ................ 3 638 715 2 269 023 71666 85 361 158 661 315688 !

1 9 1 1 ........................ 4 011996 2 469 277 73774 90141 157 839 321 754

1 9 1 2 ........................ 4 221953 2 657 691 77 869 93076 157 244 328189

1 9 1 3 ........................ 4 257 837 2 806 841 79 016 92 696 158 902 330614

(1900), Hansa (1905), and the mutual companies Bore (1888), Dalarna

(1889) and Gothia (1898). In addition to these, a number of foreign companies

carried on accident insurance in Sweden on a comparatively small

scale. The amount of the business done by the Swedish companies since

1881 is shown by Table 142.

In the year 1903 the Workmen’s Compensation Act of the 5th July 1901,

providing for compensation for damage in case of accident, entered into

force, and concurrently the Riksfôrsakringsanstalten, the State Insurance

Office, whose function is to take over the liability of employers under the

act, began its- operations.

After the beginning of the twentieth century the accident insurance

companies have gradually expanded the scope of their activities, so as to

embrace a number of other branches of insurance, such as, for instance,

illness, liability, fidelity guarantee, burglary, travellers’ luggage, glass,

and damage by water insurance.

A few figures (million kronor) are subjoined showing the business done

by the State Insurance Office and by the private companies in 1913:

Compensations Number at end of

paid year of

Insurance institutions Premiums1

Premiums

for reinsurances

gross

by

reinsurers

insured

persons

persons

insured

under the

Act of

1901

The State Insurance Office

Swedish companies . . .

Swedish mutual companies

Employers’ associations .

. . 0-78

. . . 2'92

. . . 1-33

' 0-38

0-05

0 58

1-95

0;83

0-46

003

115120

153 279

177 335

23 082

114 822

60 324

98 578

23082

Total 5’03 0-43 3-36 0-49 468 816 296 806

Foreign countries . . . . . . . 0-68 0-25 24148 11102

Total 5'71 3-61 492964 307 908

1 The figures, as regards the State Insurance Office, give

the private institutions, their tariff premiums.

the net premiums ; as regards

As to the other branches of insurance represented in Sweden, it is proposed

here only to give a few figures. According to the report of the insurance inspector

for 1912 there were engaged in cattle insurance 732 mutual companies

and societies, among which 12 embracing the whole of Sweden, or larger or

smaller parts thereof, and 720 with smaller spheres of operations as for instance,

within the radius of a lan, one or more “harad” districts, one or more

parishes.

According to the data that have been forthcoming (not quite complete) there

were insured at the close of the financial year 1911 354 756 horses and 390 725

head of cattle for 135 140 428 kronor and for 92 817 443 kronor respectively,

and in the course of the same year damage had been compensated in the case

of 10 466 horses and 2 920 head of cattle at 2 925 055 and 328 657 kronor

respectively.

Damage by Hail Insurance was granted in 1912 by one damage by hail insurance

society embracing the whole country, namely Allmanna Hagelskadefor-

sakrings aktiebolaget, mutual; and by 7 likewise mutual “County” (lan) com