vata Centralbank, a banking company founded in 1912 as a central organ

for a considerable number of average-sized provincial banks.

3. MORTGAGE INSTITUTIONS.

The mortgage banks in Sweden which serve the purposes of agriculture

have been already dealt with in a separate section (pp. 135 foil.). The most

important of the other banks of this type are Konungariket Sveriges Stads-

hypotekskassa and Stockholms Inteckningsgarantiaktiebolag.

Konungarikets Sveriges Stadshypotekskassa, The National Town Mortgage Bank

of Sweden, is managed in accordance with a Boyal Ordinance of June 5 1909

and the Regulations issued by the Government on January 18 1910. Its

capital, which has been handed over to it by the State in the form of 31/? %

bonds, amounts to 30 million kronor. The functions of the bank consist

in negotiating requisite loans for mortgage societies constituted of owners

of real property in towns and communities comparable to towns. This bank

is thus to the town mortgage societies what the General Mortgage Bank

is to the rural mortgage societies. The bank is administered by a board consisting

of five members, four of which are appointed by the Government,

and one by the National Debt Board. The administration of the board is subject,

to the inspection of three auditors, two of whom are nominated by the Government

and one by the National Debt Board. The Government determines

after hearing the opinion of the National Debt Board, whether the board’s ad-'

ministration is to be approved.

Stockholms Inteckningsgarantiaktiebolag, the Stockholm Mortgage Security

Company Ltd, also transacts banking business and is therefore included among

“other banks” in Table 140. The original object. for which the Company

was formed was “to guarantee the repayment when due of the capital sums,

either with or without interest, advanced in the form of loans on promissory

notes secured upon real estate in the compass of the City of Stockholm and

by that means to facilitate the procuring of loans of that nature”. The company

also supplies loans for building purposes. It has done very much fo |;. the

organization and strengthening of credit based on real property in Stockholm.

The share capital is 15 million kronor, and the aggregate funds amount to 25

million kronor.

Mortgage Security Companies (Inteckningsbolag) have also been formed at

Gothenburg, Gavle, Malmo (the Skanska Inteckningsaktiebolaget), Halsingborg,

and Örebro.

For some figures, see p. 139.

4. SAVINGS-BANKS AND SIMILAR INSTITUTIONS.

The oldest savings-bank, in the strict sense of the term, founded in

Sweden is the Gothenburg savings-bank, which was opened on the 28

October 1820. The city of Stockholm Savings-Bank was established in

1821, and during the latter twenties of the nineteenth century similar mstitutions

were set up in most of the provinces of Sweden, though in the

northernmost provinces not till the close of the forties and the commencement

of the fifties. The Province in which the savings-bank system

first won extensive dissemination was Malmôhus Lan, where as early

as 1850 fourteen savings-banks of some size and importance had been

established.

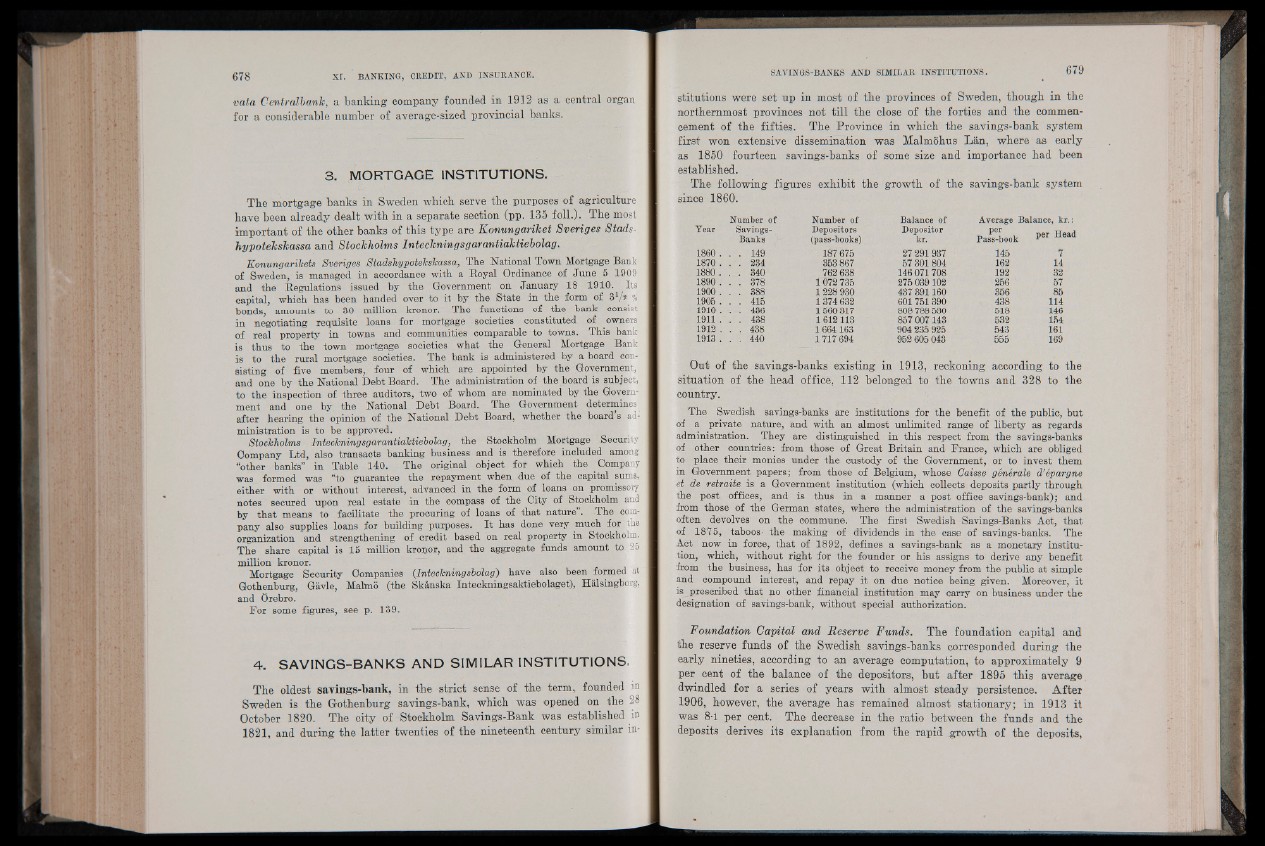

The following figures exhibit the growth of the savings-bank system

since 1860.

Number of Number of Balance of Average Balance, kr. :

Year Savings-

Banks

Depositors

(pass-books)

Depositor

kr.

per

Pass-book per Head

1860 . . . 149 187 675 27 291937 145 7

1870 . . ' . 234 353 867 57 301 804 162 14

1880 . . . 340 762 638 146 071708 192 32

1890 . . . 378 1072 735 275 039 102 256 57

1900 . . . 388 1228 930 437 391160 356 85

1905 . . . 415 1374 632 601 751 390 438 114

1910 . . . 436 1560317 808 788 530 518 146

1911 . . . 438 1 612113 857 007143 532 154

1912 . . . 438 1 664163 904 235 925 543 161

1913 . . . 440 1717 694 952 605 043 555 169

Out of the savings-banks existing in 1913, reckoning according to the

situation of the head office, 112 belonged to the towns and 328 to the

country.

The Swedish savings-banks are institutions for the benefit of the public, but

of a private nature, and with an almost unlimited range of liberty as regards

administration. They are distinguished in this respect from the savings-banks

of other countries: from those of Great Britain and France, which are obliged

to place their monies under the custody of the Government, or to invest them

in Government papers; from those of Belgium, whose Caisse générale d’épargne

et de retraite is a Government institution (which collects deposits partly through

the post offices, and is thus in a manner a post office savings-bank); and

from those of the German states, where the administration of the savings-banks

often devolves on the commune. The first Swedish Savings-Banks Act, that

of 1875, taboos the making of dividends in the ease of savings-banks. The

Act now in force, that of 1892, defines a savings-bank as a monetary institution,

which, without right for the founder or his assigns to derive any benefit

from the business, has for its object to receive money from the public at simple

and compound interest, and repay it on due notice being given. Moreover, it

is prescribed that no other financial institution may carry on business under the

designation of savings-bank, without special authorization.

Foundation Capital and Reserve Funds. The foundation capital and

the reserve funds of the Swedish savings-banks corresponded during the

early nineties, according to an average computation, to approximately 9

per cent of the balance of the depositors, but after 1895 this average

dwindled for a series of years with almost steady persistence. After

1906, however, the average has remained almost stationary; in 1913 it

was 8-1 per cent. The decrease in the ratio between the funds and the

deposits derives its explanation from the rapid growth of the deposits,