with which the distribution to the funds was unable to beep even pace. —

The following summary shows the different binds of investments.

1880 1890 - 1900 1910 1913

Bonds, outstanding claims on communes

and the lik e ................................... 16'04 % 11*60 % 16'48 % 13*79 % 14*91 %

Outstanding claims on private persons:

against mortgages ........................ 42*70 » 51*54 > 51*37 » 56*11 > 57*21 >

against su re tie s ....................................... 30*76 > 24*61 » 17*98 » 16*43 » 14*80 >

Cash and other accounts............................10*50 > 12*25 » 14*17 » 13*67 » 13*08 »

It will be seen from the above summary that the outstanding claims

bacbed by guarantor have been relatively decreasing, whereas investments

in mortgages have been coming into more and more extensive use. However,

the loans made against bacbers’ names still bulb pretty largely in

the minor savings-banbs located mostly in the country, where there is; a

personal bond between the banb and its customers. According as the banbs

increase in size, transactions of this bind are seen to figure less prominently

and the money which the public has entrusted to the banb will be invested

preferably in mortgages or in bonds. In 1913 the figures worbed out ;as

follows :

In Savings-Banks where Bonds, .

the aggregate Balance communal

of Deposits was claims etc.

Under 50 000 kr. 0 29 %

50000— 100 000 » 2-43 >

100 000— 250 000 • 4-90 >

250 000— 500 000 > 4-03 >

500 000—1000 000 j 4-75 >

1 000 000—5 000 000 > 9-58 >

Over 5 000 000 kr. . . 20*10 »

Claims on private persons against

Mortgages and

Mortgages Guarantors

Securities

Guarantors

Securities

35*23 %

37*15 »

38*59 »

38*89 >

41*52 >

46*23 >

55*30 >

2*68 %

8*85 >

9*58 >

7*74 »

8*29 »

9*19 ».

4*63 >

54*04 %

43*23 >

38*16 »

38*76 »

34*54 »

20*57 >

7*22 »

Cash

and

other

Accounts

7*76 %

8*34 >

8*77. »

10*68 »

10*90 >

14*43 >

12*75 »

The expenses of management of the savings-banbs amounted in 1913 on an

average1" to 0*43 %, in ratio to deposits, and formed 1*09 j f o i the total amount

of money passing through the hands of the bank.

The rate of interest for deposits' was on a general average for the savings-

banks of 1913 4*49 % (effective interest 4*48 %), though with great fluctuations

for banks of different size. In 39 .savings-banks, in which the..average of, the

deposited capital was about 1 825 000 kronor, the interest was 4 %, in 311

savings-banks with an average capital of about 2 560 000 kronor, i||t ,was

4Va °/o, and in 73 savings-banks, in which the capital deposited was on an

average 814 000 kronor, the interest was 5 %. — The apparent anomaly that

the smaller savings-banks, in spite of their comparatively heavy working expenses,

can afford to give a higher interest than the bigger banks, is readily accounted

for by the nature of their loan transactions. It has been explained above that

it is especially the smaller banks that carry on the more lucrative business of

lending to customers on the security of backers’ names.

The new schedules prescribed for savings-bank returns have enriched savings-

banks statistics with a fresh body of data. Of very particular interest are the

data relating to the interest charged on loans to customers. In 1913 the lowest,

generally adopted, rate of interest for loans against mortgages was 5 %. In

loans granted on the security of * guarantors the rate of interest was higher, as

a rule by a half or one per cent.

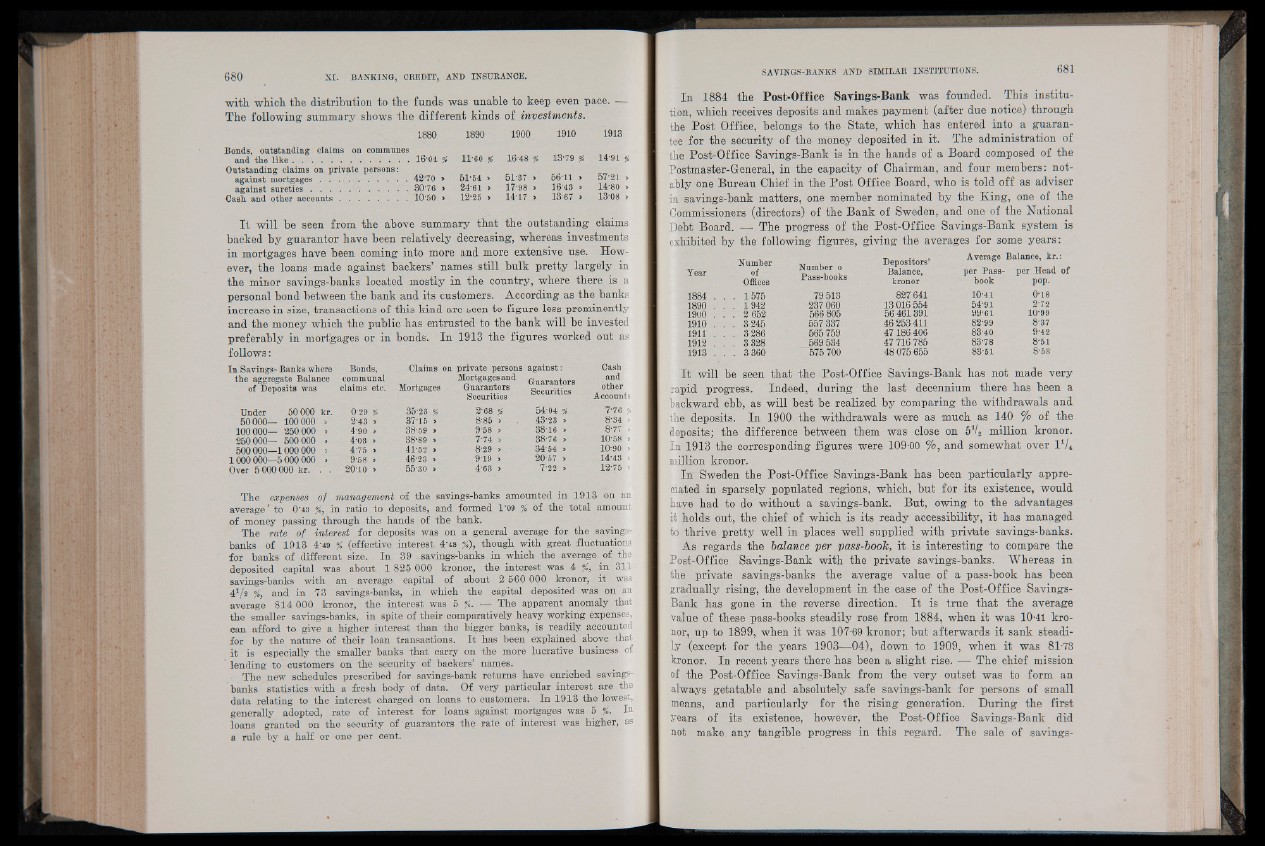

In 1884 the Post-Office Savings-Bank was founded. This institution,

which receives deposits and mahes payment (after due notice) through

the Post Office, belongs to the State, which has entered into a guarantee

for the security of the money deposited in it. The administration of

the Post-Office Savings-Bank is in the hands of a Board composed of the

Postmaster-General, in the capacity of Chairman, and four members: notably

one Bureau Chief in the Post Office Board, who is told off as adviser

in “savings-bank matters, one member nominated by the King, one of the

Commissioners (directors) of the Bank of Sweden, and one of the National

Debt Board. BHThe progress of the Post-Office Savings-Bank system is

exhibited by the following figures, giving the averages for some years:

Average Balance, kr. :

per Year Pass- per Head of

Number

of

Offices

Number o

Pass-books

1884 . . 1575 79 513

1890 . . 1942 237 060

1900 . . 2 652 566 805

1910 . . 3 245 557337

1911' 1 . 3 286 565 759

1912 . . 3328 569 534

1913 . . 3 360 575 700

Depositors’

Balance,

kronor

827 641

13 016 554

56 461391

46 253411

47 186 406

47 716785

48 075 655

book

10*41

54*91

99*61

82*99

83*40

83*78

83*51

pop.

0*18

2*72

10*99

8*37

9*42

8*61

. 8*53

It will be seen that the Post-Office Savings-Bank has not made very

rapid progress. Indeed, during the last decennium there has been a

backward ebb, as will best be realized by comparing the withdrawals and

the deposits. In 1900 the withdrawals were as much as 140 % of the

deposits; the difference between them was close on 5 ^ million kronor.

In 1913 the corresponding figures were 109*00 %, and somewhat over I1/*

million kronor.

In Sweden the Post-Office Savings-Bank has been particularly appreciated

in sparsely populated regions, which, but for its existence, would

have had to do without a savings-bank. But, owing to the advantages

it holds out, the chief of which is its ready accessibility, it has managed

to thrive pretty well in places well supplied with privlate savings-banks.

As regards the balance per pass-book, it is interesting to compare the

Post-Office Savings-Bank with the private savings-banks. Whereas in

the private savings-banks the average value of a pass-book has been

gradually rising, the development in the case of the Post-Office Savings-

Bank has gone in the reverse direction. I t is true that the average

value of these pass-books steadily rose from 1884, when it was 10*41 kronor,

up to 1899, when it was 107*69 kronor; but afterwards it sank steadily

(except for the years 1903—04), down to 1909, when it was 81*73

kronor. In recent years there has been a slight rise. ■—• The chief mission

of the Post-Office Savings-Bank from the very outset was to form an

always getatable and absolutely safe savings-bank for persons of small

means, and particularly for the rising generation. During the first

years of its existence, however, the Post-Office Savings-Bank did

not make any tangible progress in this regard. The sale of savings