bank stamps (sparmarkenJ1 during the period from 1888 to 1892 figured

out at an avierage 4 304 078, but during tbe quinquennial period from

1898 to 1902 bad no risen to more than to 4 653 073. Since tben, however,

there has been a fairly large rise; during the years from 1908 to

1912 6 535 730 sparmarken were sold.

Out of the pocket money-boxes (ficksparbdssor) kept by the Post-Office

for sale of loan, at the end of 1912, 46 926 had been supplied to the

public, out of which 22 375 were lent and 24 551 sold,

The rate of interest given by the Post-Office Savings-Bank was 3’6 % up to

the end of 1896, was then reduced to 3’3 %, but since the 1 st July 1899 has

again been raised to 3’6 %. The rate is thus lower than the average rate; of

the savings-banks (4'36 % in 1912), and considerably lower than the interest

paid by the smaller savings-banks to their depositors — an inevitable consequence

of the stringent regulations to which the Post-Office Savings-Bank had to

submit. Prior to 1902 the Post-Office Savings-Bank was not permitted!' to

invest its monies in anything but Government bonds, General Mortgage Bank

bonds, and communal bonds, or in communal loans issued on the security’ of

promissory notes (skuldebrev). In 1902, however, the Post-Office Savings-Bank

acquired the right to lend, at most, a quarter of its capital against promissory

notes on the security of mortgages. As to expenses of management, they amounted

in 1912 to 0 ‘66 % of the pass-book balances, and were thus relatively speaking,

far higher than those of the private savings-banks (0'44 % in 1912).'. It should,

however, be borne in mind that the average per pass-book in the PosirOffice

Savings-Bank was only 83’is kronor, whereas in the case of the private savings-

banks, it was 543 kronor; if one estimates the costs in ratio to the sums

passing through the hands of the banks, they are l'la % for the Post-Office

Savings-Bank, but l'io % for the private savings-banks.

People’s Banks. Tbe people’s banks bad mucb tbe same aims as tbe

savings-banks. By tbe Banks Act of 1903, tbey were deprived of the

right to bear that name (after 1903 only financial institutions for which

regulations have been drawn up by Government "are entitled to tbe

designation “bank”). Tbe former people’s banks have consequently been

rechristened with new names such as kreditbolag, credit company,' folh-

kassa, people’s fund, sparkassa, savings-fund, and tbe like. Savings-

bank operations only form part of the business tbey transact: besides

this, tbey also discount bills. Unlike the savings-banks, these institutions

do not solely serve tbe public benefit: tbey are regular business undertakings,

though only on a minor scale, giving dividends, and looking

to tbe advantage of their shareholders. An Act of 1903 bad provided

for tbe due supervision of these institutions.

In 1913 there were 26 of these institutions, all of them being in tbe country.

Tbe number of depositors on “ savings-bank account” was 20 744,

and their total balance at the close of tbe year 9 193 683 kronor. Tbe ave1

In order to provide facilities for the collection of petty sums, savings-bank stamp!

(sparmarken) worth 10 ore each are kept for sale by the post office, by rural postmen,

and by dealers. These are affixed to a cardboard sheet, which, when the amount totals »

krona, can be handed in as a deposit at the nearest post office.

rage value of a balance was 443T9 kronor, that is 112 kronor lower than

tbe value of a savings-bank book.

In tbe middle nineties tbe savings-banks were saddled with a competitor

in tbe savings-bank business transacted by tbe joint-stock banks. Tbe

first start in this direction was made in 1877, but it was not until 1869

that tbe movement began to assume momentum. At tbe close of that

year the deposits — not counting tbe savings-bank business transacted by

tbe people’s banks — amounted only to 9-1 million kronor. In 1897,

when tbe unlimited banks began to arm themselves for tbe coming abolition

of private note issue, some of them also opened up a savings-bank

acoount. Thus, tbe number of banks with savings-bank accounts rose in

tbe course of that year from 9 to 20, and tbe deposits on savings-bank

account swelled from about 211/2 million kronor to about 34 million kronor.

9 years afterwards, that is, tbe end of 1908, when tbe number of

banks bad risen to 84, all of them bad savings-bank accounts, tbe deposits

bad swelled to 251 million kronor, and tbe number o f depositors’

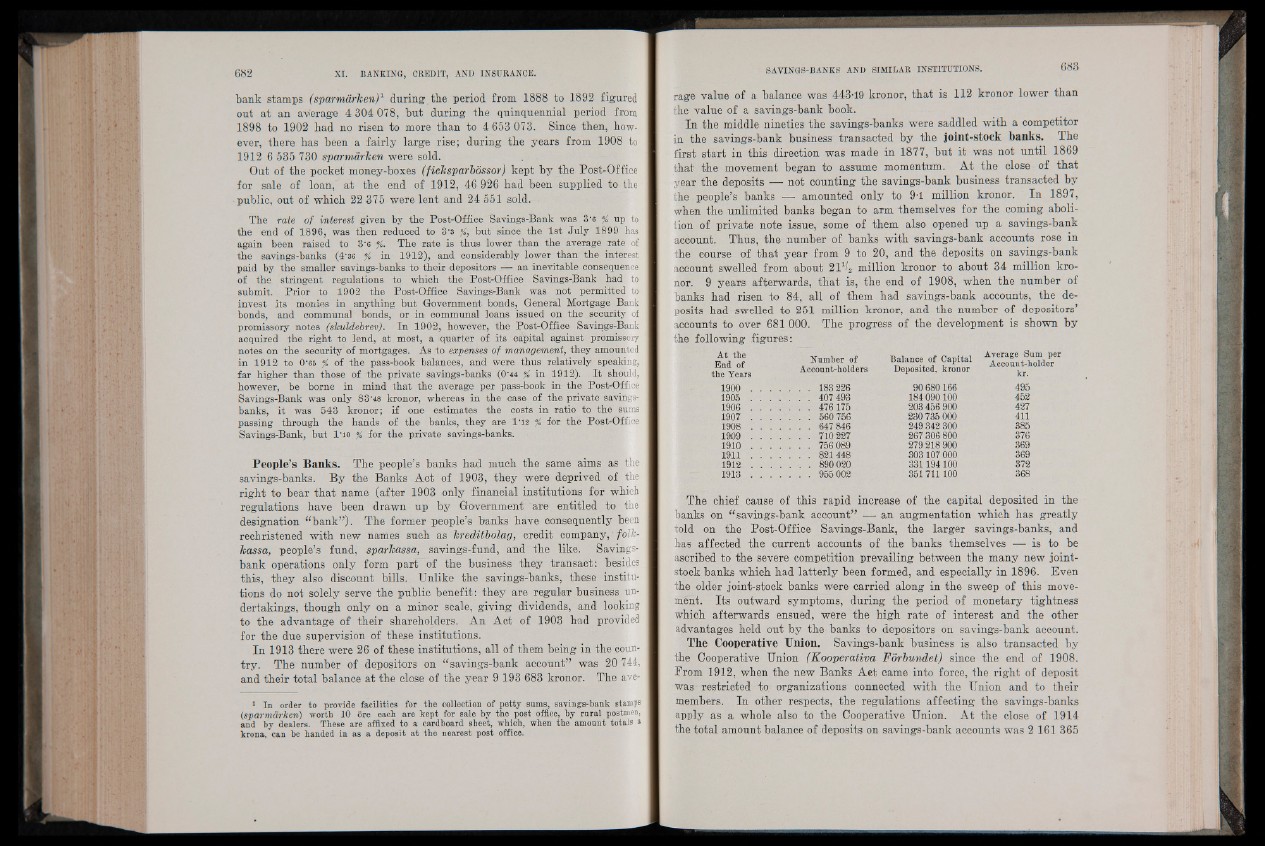

accounts to over 681 000. Tbe progress of tbe development is shown by

tbe following figures:

EnVof B B S ! Balance of Capital

the Years Account-holders Deposited, kronor

1900 ........................ 183 226 90 680 166 495

1905 ........................ 407 493 184 090 100 452

iS .9 0 6 . . . . . . . 476175 203 456 900 427

1907 . . . . . . . 560 756 230 735 000 411

1908 . . . . . . . 647 846 249 342 300 385

1909 ....................... 710 227 267306 800 376

1910 ........................ 756 089 279 218 900 369

1911 ....................... 821 448 303 107 000 369

1912............................ 890 020 331194100 372

1913............................ 955 002 351 711100 368

Tbe chief cause of this rapid increase of tbe capital deposited in tbe

banks on “savings-bank account” — an augmentation which has greatly

told on tbe Post-Office Savings-Bank, tbe larger savings-banks, and

has affected tbe current accounts of tbe banks themselves — is to be

ascribed to tbe severe competition prevailing between tbe many new joint-

stock banks which bad latterly been formed, and especially in 1896. Even

tbe older joint-stock banks were carried along in tbe sweep of this movement.

Its outward symptoms, during tbe period of monetary tightness

which afterwards ensued, were tbe high rate of interest and tbe other

advantages held out by tbe banks to depositors on savings-bank acoount.

The Cooperative Union. Savings-bank business is also transacted by

tbe Cooperative Union (Kooperativa Forbundet) since tbe end of 1908.

From 1912, when tbe new Banks Aet came into force, tbe right of deposit

was restricted to organizations connected with tbe Union and to their

members. In other respects, tbe regulations affecting tbe savings-banks

apply as a whole also to tbe Cooperative Union. At tbe close of 1914

tbe total amount balance of deposits on savings-bank accounts was 2 161 365