The safe keeping and productive investment of smaller savings

are partly effected through the common banking institutions, partly,

and more especially, by the means of the savings banks. In order

to protect the depositors, some general rules have been established

by law, relating to the organisation and business of these institutions.

For instance their plans must , be sanctioned by the king, and

they are under the supervision of the Finance Department. They

must have a minimum working-capital and the surplus resulting from

the operations of any bank must be added to its fundamental fund

until the latter reaches one tenth of the amount\of the obligations

of the bank. The excess may be employed for purposes of public

utility. The plans of the banks are not sanctioned unless they

contain satisfactory stipulations, guaranteeing an appropriate and

sufficiently controlled activity. The money deposited is chiefly

made productive either by loan on mortgage of real estate, or

on personal security with two or more endorsements. To these

transactions, however, legislation has set certain limits. As the

savings banks are primarily calculated to make smaller savings

productive, they do not, as a rule, accept deposits, beyond a

certain amount fixed in the plan of the bank. The deposits are

made on the conditions peculiar to savings bank, i.e. that they

cannot be taken out except after notice having been given a

certain time in advance, the length [of the time being proportionate

to the amount that is to be paid out.

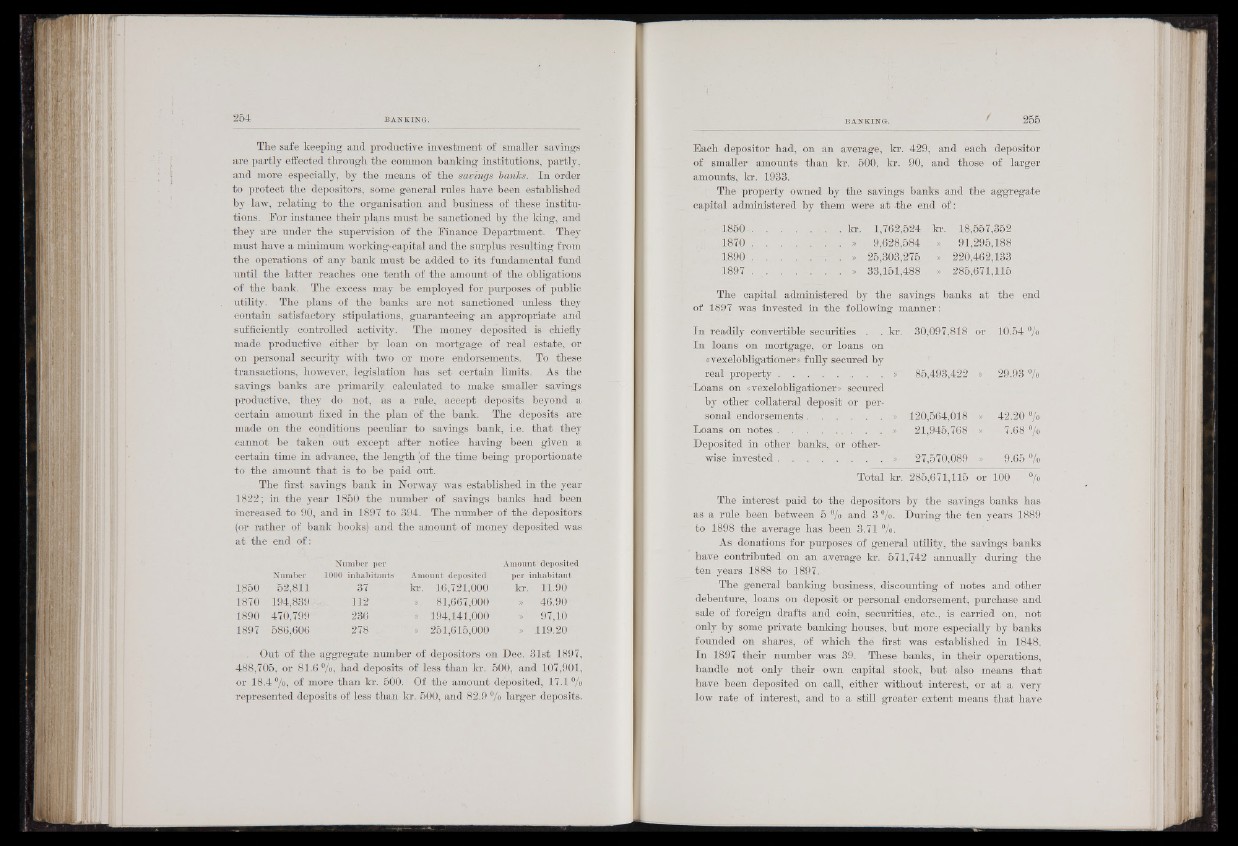

The first savings bank in Norway was established in the year

1822; in the year 1850 the number of savings banks had been

increased to 90, and in 1897 to 394. The number of the depositors

(or rather of bank books) and the amount df money deposited was

a t the end of:

Number per Amount' deposited

Number 1000 inhabitants Amount deposited per inhabitant

1,850 52,811 37 kr. 16,721,000 kr. 11.90

1870 194,839 ; 112 ». 81,667,000 ' » 46.90

1890 470,799 236 194,141,000 97,10

1897 586,606 278 v » 251,615,000 119.20

Out of the aggregate number of depositors on Dec. 31st 1897,

488,705, or 81.6 %, had deposits of less than kr. 500, and 107,901,

or 18.4 °/o, of more than kr. 500. Of the amount deposited, 17.1 Vo

represented deposits of less than kr. 500, and 82.9 % larger deposits.

Each depositor had, on an average, kr. 429, and each depositor

of smaller amounts than kr. 500, kr. 90, and those of larger

amounts, kr. 1933.

The property owned by the savings banks and the aggregate

capital administered by them were at -the end of :

1850

1870

1890

1897

kr. 1,762,524

9,628,584

25,303,275.

33,151,488

kr. 18,557,352

91,295,188

220,462,133

285,671,115

The capital administered by the savings banks at the end

of 1897 was invested in the following manner:

In readily convertible securities . . kr.

In loans on mortgage, or loans on

«vexelobligationer» fully secured by

real property....................................~~P~-

Loans on «vexelobligationer» secured

by other collateral deposit or personal

endorsements. . . . . , »

Loans on notes .' .' . . . . . . . >

Deposited in other banks, or otherwise

invested . ......................... »

30,097,818 or 10.54 Vo-

85,493,422

120,564,018

21,945,768

27,570,089

29.93 %

42.20 °/o

7.68 °/o

9.65 %

Total kr. 285,671,115 or 100 %

The interest paid to the depositors by the savings banks has

as a rule been between 5 °/o and 3%. During the ten years 1889

to 1898 the average has been 3.71 %>■

As donations for purposes of general utility, the savings banks

have contributed on an average kr. 571,742 annually during the

ten years 1888 to 1897.

The general banking business; discounting of notes and other

debenture, loans on deposit or personal endorsement, purchase and

sale of foreign drafts and coin, securities, etc., is carried on, not

only by some private banking houses, but more especially by banks

founded on shares, of which the' first was established in 1848.

In 1897 their number was 39. These banks, in their operations,

handle not only their own capital stock, but also means that

have been deposited on call, either without interest, or at a very

low rate of interest, and to a still greater extent means that have