FINANCER.

for which state bonds, not subject to be called in by tbe creditor,

bad been or were now issued; and tbe country furthermore undertook

to pay to Denmark a fixed amount of kr. 12,000,000, wbicb

was to be paid in instalments in tbe -course of 10 years. This

last mentioned debt, however, tbe Norwegian Treasury was unable

to pay out of its ordinary revenue and it, therefore, covered it

by raising two public loans, in 1820 and 1822 respectively. These

loans were obtained abroad, but, on account of the poor credit

which the Norwegian state at that time enjoyed, they had to be

made on extremely onerous conditions. As the country, however,

notwithstanding the hard times, punctually met its obligations, its

credit soon improved, and after a short time the first loans could

be exchanged for new loans obtained on very favourable terms.

These loans, together with some minor loans raised in the twenties,

were gradually repaid, and as no new loans were made for some

time, the national debt at the end of the year 1847 was reduced

to a point never attained either before or since. While the state had

commenced its independence with a debt of about kr. 25,650,000,

this had now been reduced to about kr. 7,250,000, whereof kr.

900,000 represented terminable debt and kr. 6,350,000 were

perpetual.

The revenues of the Treasury, as indicated above, were at

first very scarce. For each of the budget years 1816 to 1818 they

were estimated at only 5,748,400 kr., but they rose gradually, so

that in the forties they amounted on an average to kr. 11,000,000.

The chief source of income was represented by the taxes,, which

in the forties represented % of the total revenue. The chief taxes

again were the customs and excise duties and the direct tax on

property and income introduced in 1816, which at the beginning

was levied to the amount of kr. 2,400,000 annually, but was

gradually reduced and entirely repealed in 1836. The customs

duties and excises during the first few years amounted to about

kr. 2,700,000, and gradually increased ,(notwithstanding that the

excises were repealed in 1827), so that in the forties they amounted

on an average, to kr. 7,950,000, while the other duties at the same

time amounted to kr. 875,000.

Of the state expenditure, which in the forties amounted, on

an average, to kr. 10,600,000 annually, kr. 4,075,000 were then

voted to the defences, kr. 3,825,000 to the royal family, Storthing,

civil administration, courts and police, kr. 850,000 to the payment

FINANCES. 233

of interest and instalments on the national debt, kr. 300,000 to

pensions, and kr. 225,000 to foreign affairs. To cover all the

other objects of the state, such as public instruction, sanitation,

advancement of trade and industry, means of communication, etc.,

which now play such an important part in our state budget, there

was then left only an aggregate amount of kr. 1,300,000.

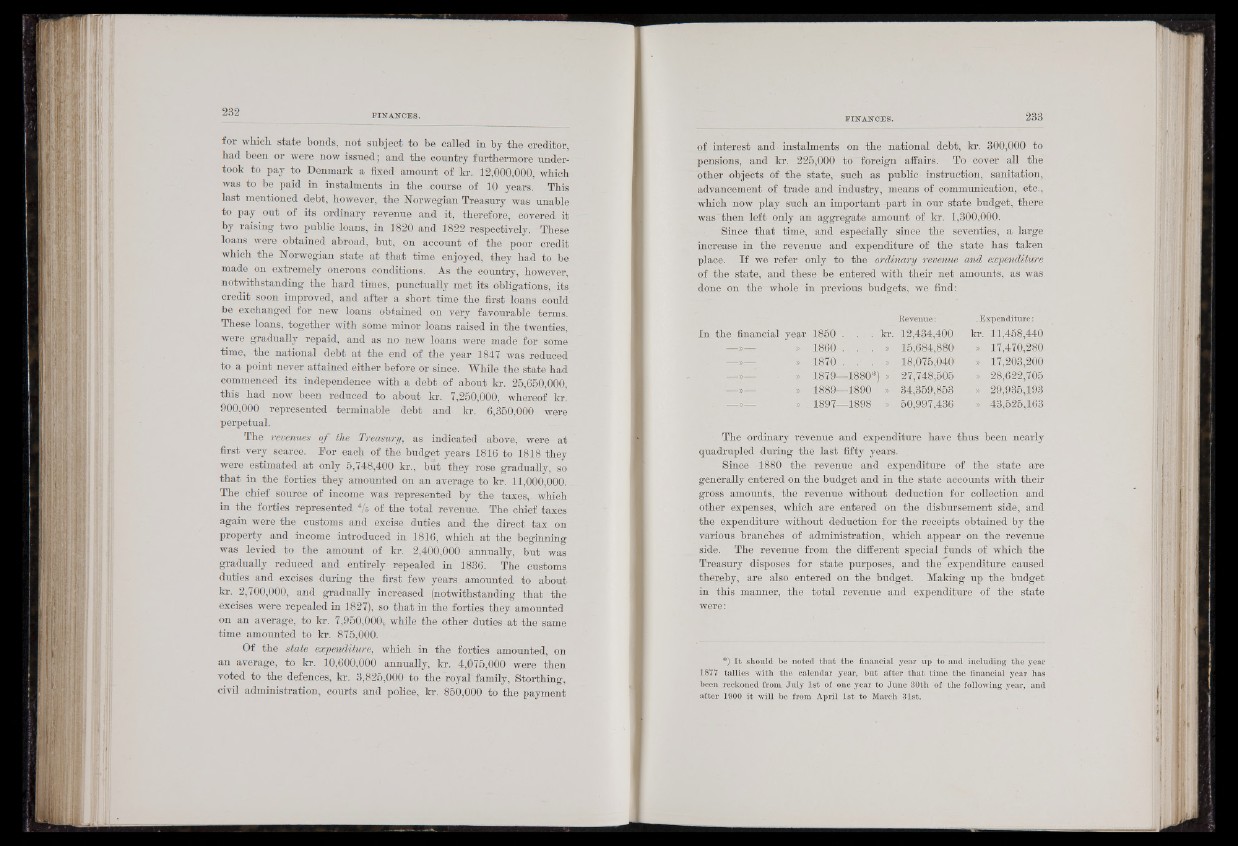

Since that time, and especially since the seventies, a large

increase in the revenue and expenditure of the state has taken

place. If we refer only to the ordinary revenue and expenditure

of the state, and these be entered with their net amounts, as was.

done on the whole in previous budgets, we find:

In the financial year 1850 .

r> 1860 .

! Y 1870 . . .

1879—1880*

Y ÿ 1889—1890

■ 1897—1898

kr.

Revenue :

12,434,400

15,684,880

18,075,040'

27,748,505

34,359,853

50,997,436

. Expenditure :

kr. 11,458,440

, » 17,470,280

» 17,203,200

> 28,622,705

» 29,935,193

» 43,525,163

The ordinary revenue and expenditure have thus been nearly

quadrupled during the last fifty years.

Since 1880 the revenue and expenditure of the state are

generally entered on the budget and in the state accounts .with their

gross amounts, the revenue without deduction for collection and

other expenses, which are entered on the disbursement side, and

the expenditure without deduction for the receipts obtained by the

various branches of administration, which appear on the revenue

side. The revenue from the different special funds of which the

Treasury disposes for state purposes, and the expenditure caused

thereby, are also entered on the budget. Making up the budget

in this manner, the total revenue and expenditure of the state

were:

®) I t should be noted th a t the financial year up to and including the year

1877 tallies with the calendar year, hut after th a t time the financial year has

heen reckoned from July 1st of one year to June 30th o f the following year, and

after 1900 it will he from April 1st to March 31st.