Of the receipts of the year 1892, 10.66 % represent income

from real estate and other assets, 12.18 °/o various items other

than the taxes, while the last-named were 77.16 %, and, for

the towns and rural districts " separately, 74.01 °/o and 80.59 %,

respectively. These items have increased from kr. 4,145,000, during

the year 1852, to 11,621,000 in 1872 and, as mentioned above,

to kr. 21,639,152 in 1892. As with the state, so also for the

municipalities are the taxes the chief source of revenue. But

while the indirect taxes play the most important part in the state’s

finances, it is different with the municipalities where by far the

larger part of the taxes is collected in the shape of direct taxes

on movable property and income, as well as on real estate.

By the acts relating to municipal taxation, direct” taxes can

he levied, with certain limitations, either on real estate, personal

property and income or on personal property and income alone.

As a rule both bases of taxation are used simultaneously. Of

the total amount of taxes levied in the year 1894, the tax on real

estate represented 24.66 % in the towns, and in the rural districts

33.36 °/o, and the tax on personal property and income in

the towns 75.34 °/o and in the rural districts 66.64 %>. The tax on

real estate in the towns is imposed upon buildings and real

property of every kind, And in the rural districts on registered

properties and on- various industrial establishments. Taxes are

paid in a certain ratio of the value of the property, either

according to the property register or by special assessment, without

reference to debt encumbering the property. The tax on personal

property and income is, as far as the income is concerned, calculated

on the rest of income remaining after deduction of interest

on debt and of all expenses which can be estimated as having

been incurred for the purpose of earning the income. The tax levied

on personal property should be no more than Vso and no less than

Vto of the tax levied upon the same amount of revenue. A certain

amount of every income must be free of taxation. This amount

depends upon the extent to which the party assessed is liable for

the support of other people, and although in the rural districts

only within certain limitations — on the amount of his income.

The tax is levied on all income subject to taxation in the Same

ratio, no matter what the amount of the income may be.

As in the case of the direct tax paid to the state Treasury,

nobody is compelled to give any information about his own property

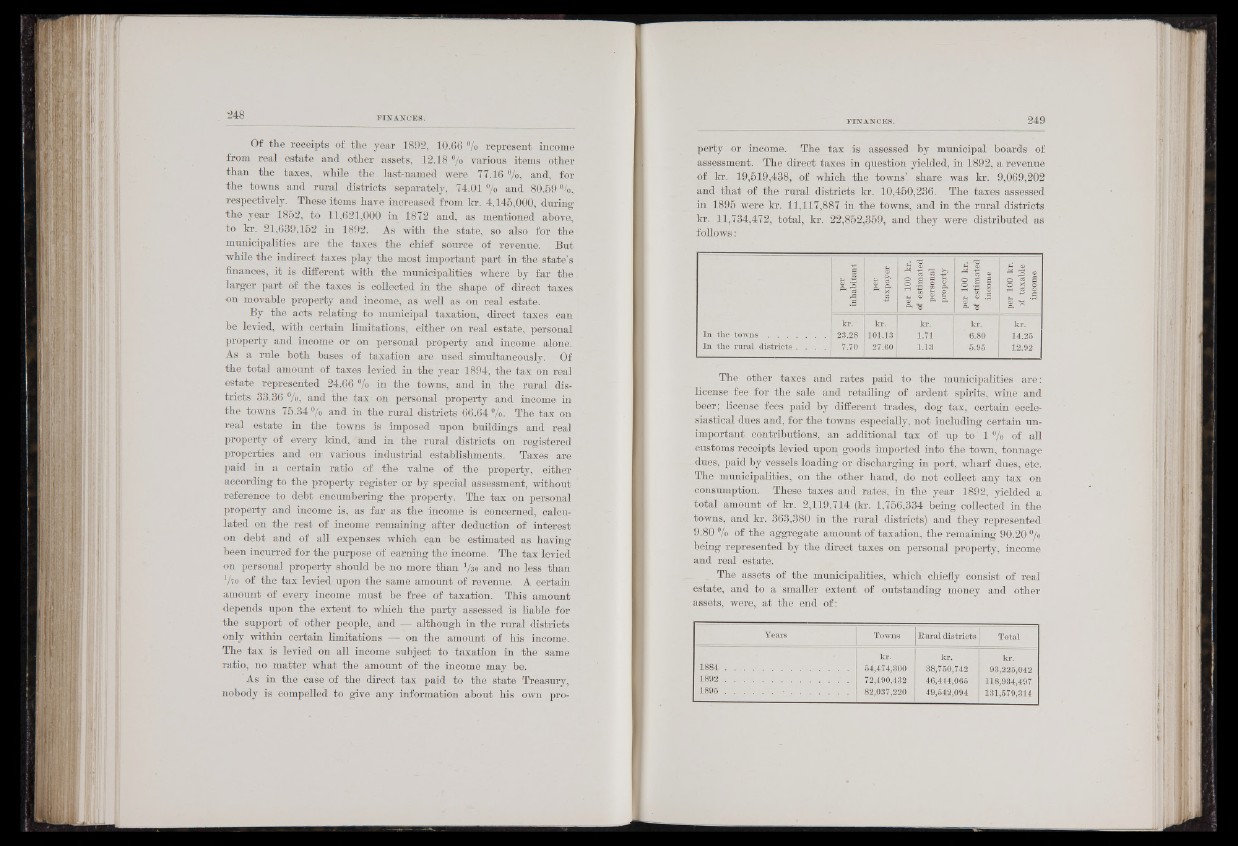

or income. The tax is assessed by municipal boards of

assessment. The direct taxes in question yielded, in 1892, a revenue

of kr. 19,519,438, of which the towns’ share was kr. 9,069,202

and that of the rural districts kr. 10,450,236. The taxes assessed

in 1895 were kr. 11,117,887 in the towns, and in the rural districts

kr. 11,734,472, total, kr. 22,852,359, and they were distributed as

follows:

In the towns . . . .

In the rural districts—.

kr.

23.28

7.70

kr.

101.13

27.60

kr.

1.71

1.13

kr.

6.80

kr.

14.26

12.92

The- other taxes and rates paid to the municipalities are:

license fee for the sale and retailing of ardent spirits, wine and

beer; license fees paid by different trades, dog tax, certain ecclesiastical

dues and, for the towns especially, not including certain unimportant

contributions, an additional tax of up to 1 °/o of all

customs receipts levied upon goods imported into the town, tonnage

dues,- paid by vessels loading or discharging in port, wharf dues, etc.

The municipalities, on the other hand, do not collect any tax on

consumption. These taxes and rates, in the year 1892, yielded a

total amount of kr. 2,119,714 (kr. 1,756,334 being collected in the

towns, and kr. 363,380 in the rural districts) and they represented

9.80 % of the aggregate amount of taxation, the remaining 90.20 °/o

being represented by the direct taxes on personal property, income

and real est.ate.

, The assets of the municipalities, which chiefly consist of real

estate, and to a smaller extent of outstanding money and other

assets, were, at the end of:

Years Towns Rural districts Total

kr. kr. kr.

1884 ......................... 64,474,300 38,760,742 93,226,042

1892 ......................... 72,490,432 46,444,065 118,934,497

1895 .....................• . 82,037,220 49,642,094 131,679,314