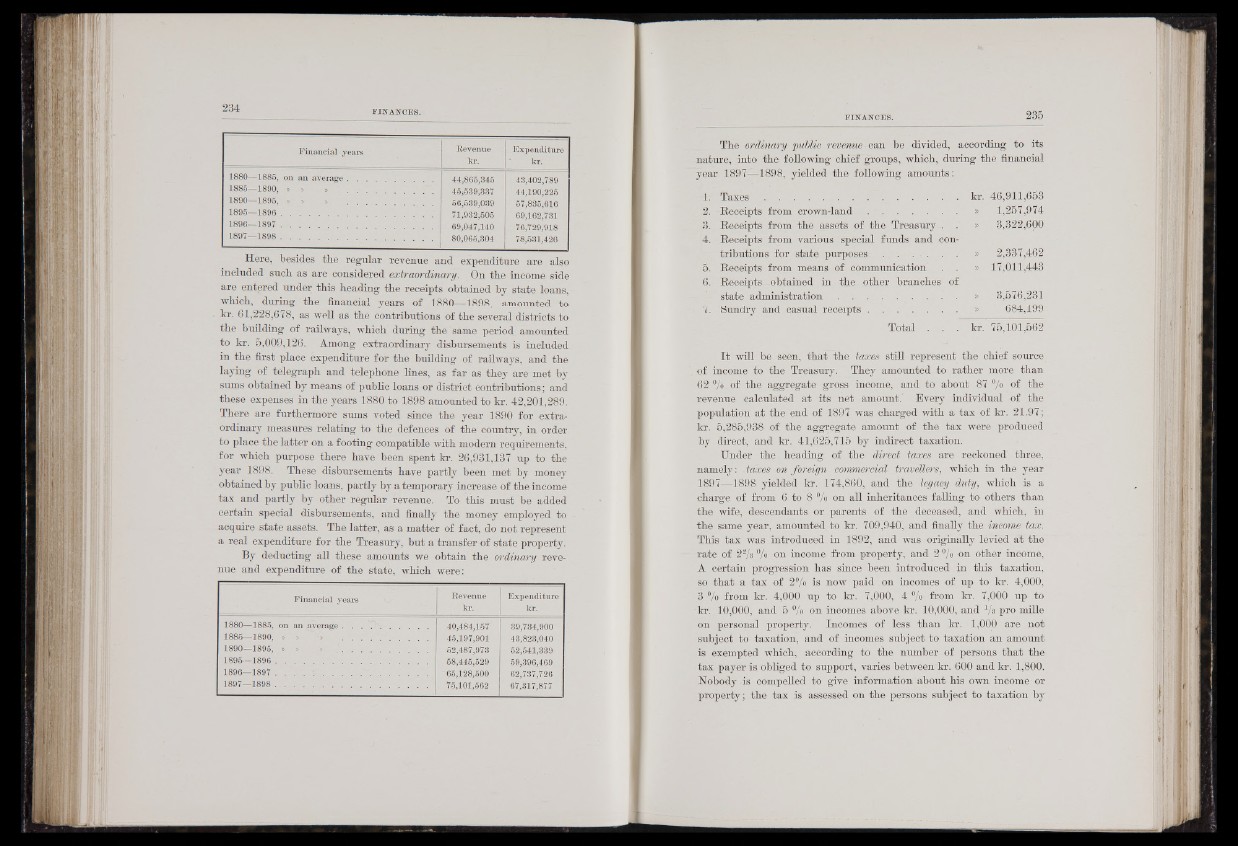

Financial years Revenue

kr.

Expenditure

kr.

1880—4885, on an av erage......................................

1885—1890, » » »

1890—1896, » » »

1895—1896 . . . .

1896—1897 .....................

1897—1898 .....................

44,865,845

46*539;337

56,539,039

71,932,506

69,047,140

80,065,304

43,402,789

44,190,225

57,835,616

69,162,731

76,729,918

78,531,426

Here, besides the regular revenue and expenditure are also

included such as are considered extraordinary. On the income side

are entered under this heading the receipts obtained by state loans,

which, during the financial years of 1880—1898, amounted to

kr. 61,228,678, as well as the contributions of the several districts to

the building of railways, which during the same period amounted

to kr. 5,009,126. Among extraordinary disbursements is included

in the first place expenditure for the building of railways, and the

laying of telegraph and telephone lines, as far as they are met by

sums obtained by means of public loans or district contributions; and

these expenses in the years 1880 to 1898 amounted to kr. 42,201,289.

There are furthermore sums voted since the year 1890 for extraordinary

measures relating to the defences of the country, in order

to place the latter on a footing compatible with modem requirements,

for which purpose there have been spent kr. 26,931,137 up to the

year 1898. These disbursements have partly been met by money

obtained by public loans, partly by a temporary increase of the income

tax and partly by other regular revenue. To this must be added

certain special disbursements, and finally the money employed to

acquire state assets. The latter, as a matter of fact, do not represent

a real expenditure for the Treasury, but a transfer-of state property.

By deducting all these amounts we obtain the ordinary revenue

and expenditure of the state, which were:

Financial years Revenue

kr.

Expenditure

kr.

1880—1885, on an average . . . . . . . .

1885—1890, » » ' » . . . . . . . . . .

1890—1895, » » » - ! ......................................

1895—1896 ..........................................

1896—r-1897 . . . . Ü .................

1897—1898 ......................... ....

40,484,157'

45,197,901

52,487,973

58,445,529

65,128,500

75,101,562

39,734,900

43,823,040

62,541,339

59,396,469

62,737,726

67,317,877

The ordinary public revenue can be divided, according to its

nature, into the following chief groups, which, during the financial

year 1897—1898, yielded the following amounts:

1. T a x e s .............................................................. kn 46,911,653

2. Receipts from c row n -la n d ............................. » 1,257,974

3. Receipts from the assets of the Treasury . » 3,322,600

4. Receipts from various special funds and contributions

for state purposes . . . . , . f f f f . 2,337,462

5. Receipts from means of communication . . S 17,011,443

6. Receipts obtained in the other branches of

state administration ..........................................» 3,576,231

7. Sundry and casual receipts..............................» 684,199

Total . . . kr. 75,101,562

I t will be seen, that the taxes still represent the chief source

of income to the Treasury. They amounted to rather more than

62 % of the aggregate gross income, and to about 87 °/o of the

revenue calculated at its net amount. Every individual of the

populations at the end of 1897 was charged with a tax of kr. 21.97;

kr. 5,285,938 of the aggregate amount of the tax were produced

by direct, and kr. 41,625,715 by indirect taxation.

Under the heading of the direct taxes are reckoned three,

namely: taxes on foreign commercial travellers, which in the year

1897—1898 yielded kr. 174,860, and the legacy duty, which is: a

charge of from 6 to 8 °/o on all inheritances falling to others than

the wife, descendants or parents of the deceased, and which, in

the same year, amounted, to kr. 709,940, and finally the ineome tax.

This tax was introduced in 1892, and was originally levied at the

rate of 22/s % on income from property, and 2 % on other income,

A certain progression has since been introduced in this taxation,

so that a tax of 2% is now paid on incomes of up to kr. 4,000,

3 % from kr. 4,000 up to kr. 7,000, 4 % from kr. 7,000 up to

kr. 10,000, and 5 % on incomes above kr. 10,000, and V* pro mille

on personal property. Incomes of less than kr. 1,000 are not

subject to taxation, and of incomes subject to taxation an amount

is exempted which, according to the number of persons that the

tax payer is obliged to support, varies between kr. 600 and kr. 1,800.

Nobody is compelled to give information about his own income or

property; the tax is assessed on the persons subject to taxation by