The operation of fuch a loan, from, the Government to the

fubjeft, fo much the reverfe of what generally takes place in

other ftates, might be fappofed to produce on the minds of the

people a difpofition of ill-will towards the Government; which,

indeed, was affigned as one of the motives to ihake off their dependence,

and thus free themfelves at once from a load of debt

by the deftrufiion of the creditor. Thefe Ihort-fighted people

did not reflea that the whole amount of paper money iffued

through the bank was not half the amount of paper currency in

circulation} that a much greater furn, of the feme fabric, but

made on a different occafion, had been borrowed by Government

from the inhabitants, for which the only fecurity was its

credit and liability. The confequence of Suffrein’s vifit to the

Gape, and the expences of throwing up the lines, and putting

the works in repair, obliged the Dutch to borrow plate and

filver money from the inhabitants for the exigencies of Government,

which was promifed to be repaid on the arrival of the

fhips then expected from Holland} and, in the mean time,

damped paper, in pieces bearing different values, was given and

thrown into circulation, none of which has ever been redeemed

by fpecie, nor, in all human probability, ever will. The balance

ofthe paper lent by Government, and of the money borrowed

from the people, is about 240,000 rix dollars in favour

of the latter, fo that they would gain little by deilroying the

«redit of Government.

13. The duty ariling from ftamped paper was early introduced,

hut limited to fuch public writings as were iffued from

the offices of.thc Secretary of Government and of the Court of

Juftice;

jfuftice} and for a£ts figned by public notaries, until the arrival

of the Commiffaries General, when it was caniiderably extended.

At prefent all bills of fele, receipts, petitions, and memorials,

muft be made out on ftamped paper. The limits of

the ftamps are fixpence the loweft, and one hundred rix dollars

or twenty pounds the higheft.

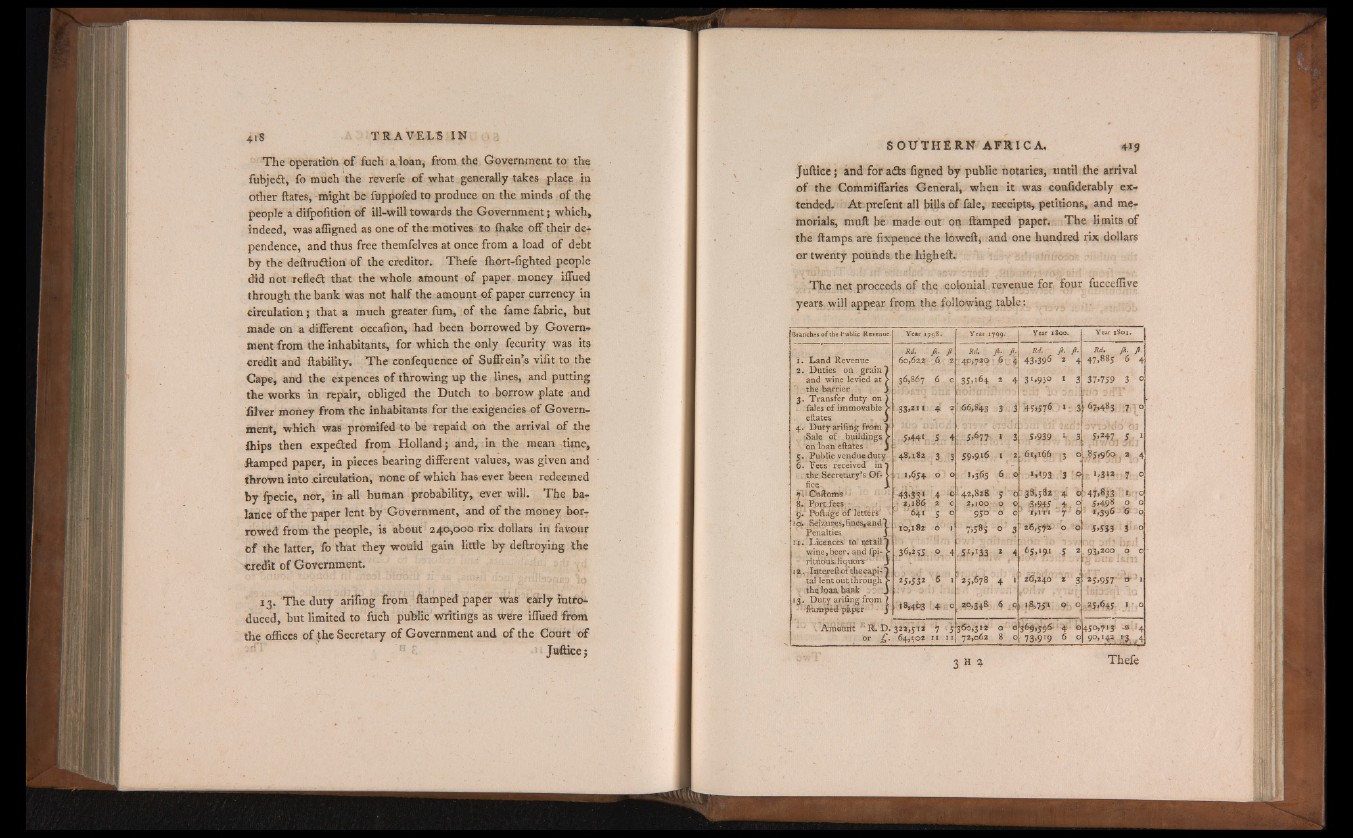

The net proceeds of the colonial.revenue for four fucceffive

years will appear from the following table:

Branches of the Public Revenue. Year 1798.

1. Land Revenue

2. Duties on grain")

and wine levied at >

the barrier y

3. Transfer duty on )

. fales o f immovable >

eftates - 3

4. Duty ariiirig fro*i J

¡Sale of buildings >

oh 'loan eftates 1 3

5. Public vendue duty

0. Fees-received m l

the Secretary’s Of- >

fic^. 3

•jl - Guftoros ■ >

Pp^f.f?es -

g . P o fta g c i o f l6 tt^ r§ J V

ipk Seixui^Sjftnes^and)

Penalties y

11. Licences to ^etailT

wine^beer, and fpi- >

® Htdo'U^HquotS''' ‘ j

12. Intereftofthecapi-)

tal lent out tnrougli >

the lorn hank j

13. Duty arifing from ?

ffampeif pfipelr j

Rd. Jk. JÏ

60,62% 6 2

36,867 6. c

53,in 4 ?

5*44* 5

48.182 3

1.1,654 o

45*35-* 4

r 2,186 2

1 5

10.182 o

36.255 0

25.532 6

«*rfP3 4

. Aincfàttt 1 RLD. 322,512 <7

or £ . 64,502 11

R d , Jk.

_4P>7<*® • 6

35,164. 2

66,843 j

5.477 •

59.916 i

1.363 6

42,82ft 5

2,100 T,<^

950 a

7.5*5 o

0 % *

25,678 4

20,348 6

360*3 *2 a

72,062 8 o

Rd. J . j

43.396 *

3'.930 >

45.376 >

5-939 w

6itï66 3

M 93 '3

38Ì5S2 4!

, 3,945 , 4 i,,¥i t .

M. jk. Jk.

47,885 6 4

37,759 3 o

67,483 7 o

5>24r Sy.1

85,960. 2 4

B 1 ,3 « 7 o

47»$$ '*• 'O

5,498 o o

1,396 6 o

2 6,5^ o * 5>SS3 r o

65. >91 5

93,200 o o

*5*957’ & *

26,240 2

1&75& q> i-o

369.556- 4

73-9 '9 6

0450,7.3 -a .4

O] 9 0 ,1 4 ^ I f f 4

111